Dubai Sports City Hotel Investment

Essential Developer Review and Cautionary Advice

Dubai Sports City (DSC) remains a key area of interest for global property investors, offering strong rental potential driven by major sporting facilities and residential demand. For those exploring hotel room and serviced apartment investments in this growing community, careful due diligence on the developer and the associated management model is essential to protect your capital and expected returns.

The appeal of Dubai Sports City properties often lies in the promise of passive income through hotel management schemes. Developers offer to build, furnish, and manage the unit, returning a percentage of rental income to the investor. While this model can be convenient, the success hinges entirely on the integrity of the developer and the fairness of the management contract. Investors should thoroughly research the developer's track record, the performance history of their other managed properties, and the fine print of the operational agreements.

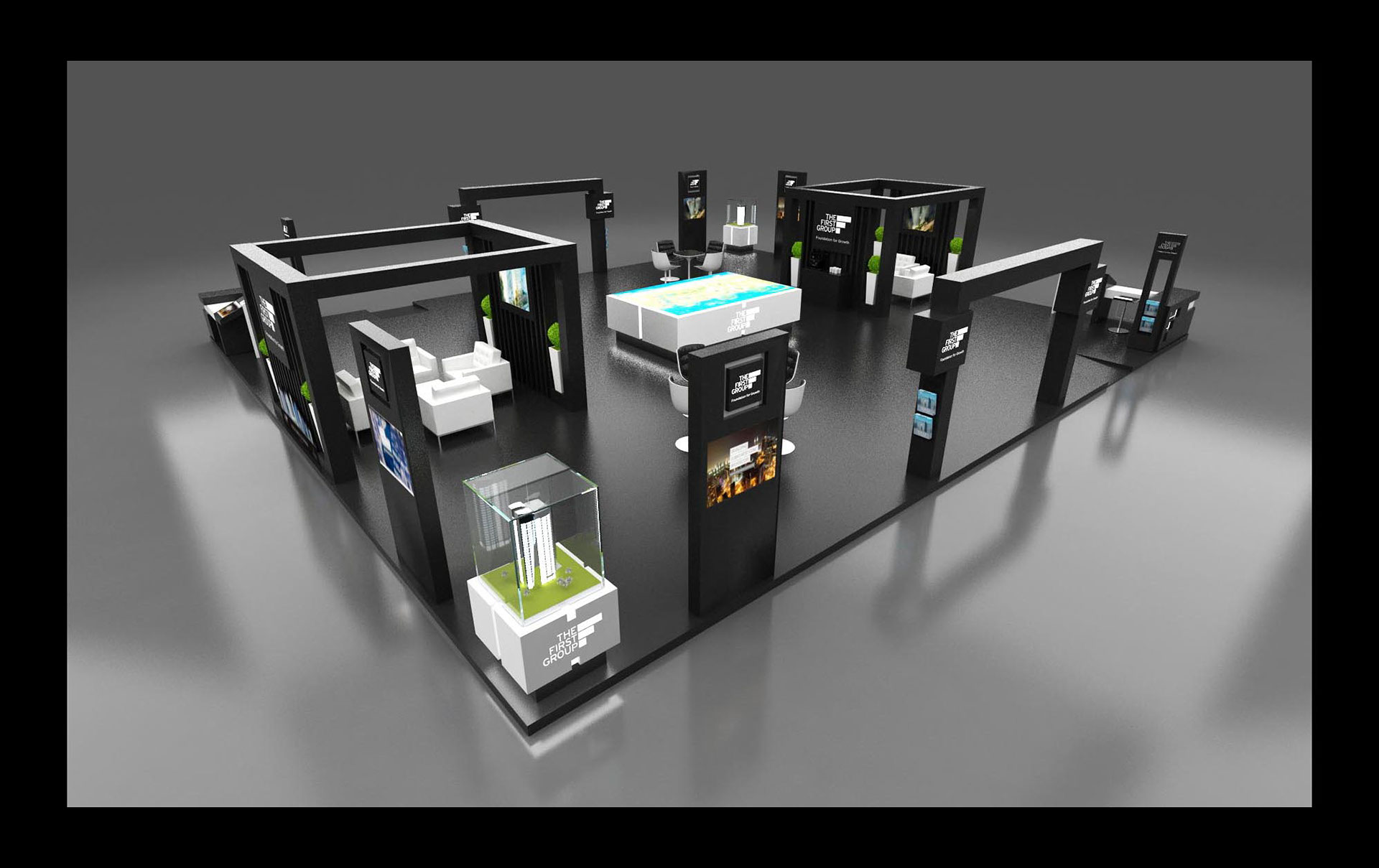

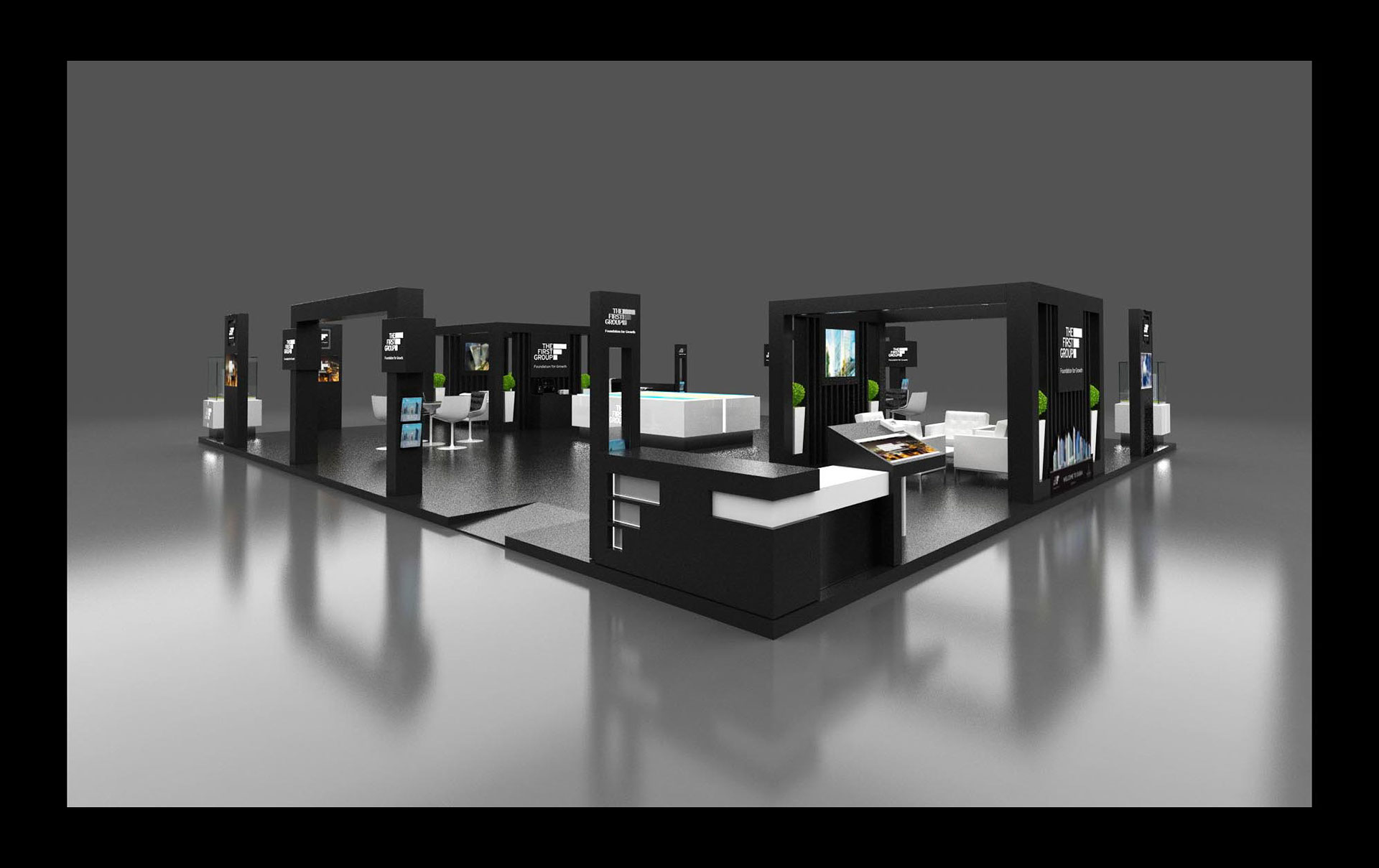

One developer frequently operating in this sector is The First Group (TFG). Based on extensive reports and public exposure, prospective investors are strongly advised to exercise extreme caution and fully understand the risks associated with their operating model before committing any funds.

The operational strategy employed by The First Group often follows a pattern that can lead to disappointment for the investor. Their primary business model involves selling individual hotel units or rooms under a long-term management contract, where TFG manages the asset and pays returns. However, the returns often fail to meet initial projections due to high-pressure, boiler-room-style sales tactics which prioritize quick closing over balanced financial information.

Furthermore, investors often receive limited or unclear insight into the actual revenue and operating costs of the hotel (operational opacity), and fees, maintenance, and administrative charges can erode profits significantly. Initial financial forecasts used to justify the investment have consistently failed to materialize into real returns, leaving investors with lower-than-expected rental yields.

The contract also grants the developer total control over the management and financial operations of the unit for decades, leaving the investor with little recourse if performance is poor, and these complex management contracts make the units challenging to resell (exit strategy difficulty).

The combination of aggressive sales methods, restrictive contracts, and a track record of underperforming returns makes TFG a developer that experienced investment analysts recommend avoiding. The structure appears heavily skewed in favor of the developer's management fees and costs, rather than maximizing returns for the individual owner.

If you are considering an investment in a Dubai Sports City hotel unit, prioritize developers with transparent operational models, shorter and more flexible management contracts, and independently verified financial returns. Always seek independent legal counsel specialized in UAE property law before signing any binding agreements.